Individuals

Any individual who is competent under Indian law (i.e., of sound mind and above 18 years of age) can create and register a trust for charitable or religious purposes.Groups of Individuals

Two or more individuals can come together as trustees to form and register a trust. They jointly manage the trust and ensure that its objectives are fulfilled.Companies or Organizations

Registered companies, societies, or other legal entities can also apply for trust registration to carry out charitable, religious, or social activities as part of their corporate social responsibility (CSR) or philanthropic goals.

Trust Registration

Trust Registration in India.

Trusts are created to serve various charitable and social purposes such as promoting education, providing medical aid, supporting scientific and literary advancements, and helping those in need. They are a legal way to ensure that noble causes are carried out in an organized and lasting manner. By setting up a trust, individuals or groups can work towards the welfare of society in a structured and impactful way.

Trust registration is a mandatory process in India to ensure legal recognition and protection of the trust. Once registered, a trust becomes an irrevocable entity, which means it cannot be altered, moved, or cancelled without the approval of a competent court. This legal status helps the trust gain credibility, attract donations, and operate in accordance with its stated objectives. Though the registration process might seem complex at first, it is essential for the long-term success and transparency of the trust.

Vakilsearch makes the trust registration process simple, fast, and completely online. With the help of a few key documents such as the trust deed, identity proof, and a rental agreement (if needed), Vakilsearch takes care of everything from document drafting to final registration. Their expert team ensures a smooth and hassle-free experience so you can focus on your mission to make a difference.

Trust Registration With Onecall Tax Solution

Benefits of Trust Registration.

Benefits of Trust Registration in India

Legal Identity and Protection

Registering a trust in India gives it a distinct legal identity. This allows the trust to own property, open bank accounts, and enter into legal agreements in its name. It also provides legal protection to the trust’s assets and ensures smooth functioning under the law.Tax Benefits and Exemptions

A registered trust can apply for tax exemptions under Sections 12A and 80G of the Income Tax Act. These exemptions help the trust save on taxes and also encourage individuals and companies to donate by offering them tax deductions on their contributions.Increased Credibility and Public Confidence

Trust registration enhances the trust’s credibility in the eyes of donors, government agencies, and the general public. It builds transparency and accountability, which helps in securing funding, grants, and partnerships. Registered trusts are more likely to be trusted for long-term charitable and social work.

Who can apply for Trust Registration.

Documents required for Trust Registration.

| Document | Details |

|---|---|

| Trust Deed | Main legal document defining the trust’s objectives, rules, and responsibilities. |

| ID Proof of Settlor and Trustees | Aadhar Card, PAN Card, Passport, Voter ID, or Driving License of all settlors and trustees. |

| Address Proof of Settlor and Trustees | Utility bill, bank statement, passport, or any official document showing current residential address. |

| Registered Office Address Proof | Electricity bill, property tax receipt, or rent agreement along with No Objection Certificate (NOC) from the owner. |

| Photographs | Passport-sized photos of the settlor and all trustees. |

| PAN Card | PAN card of the settlor and trustees (mandatory for income tax-related registrations). |

| Witness ID Proof | ID proof (Aadhar, PAN, etc.) of two witnesses signing the trust deed. |

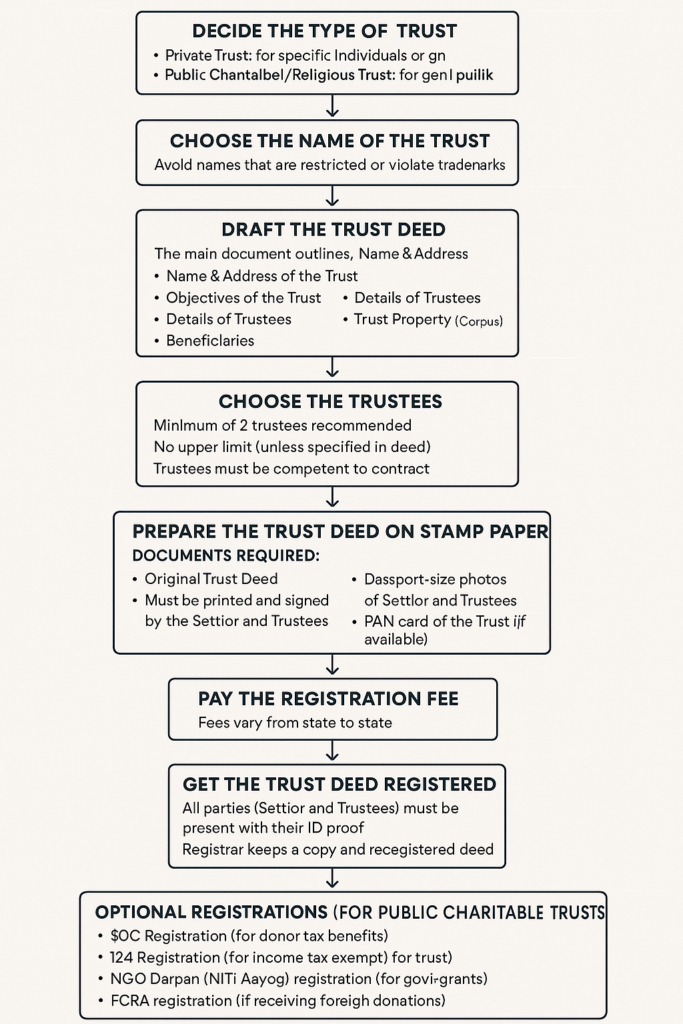

Process of Trust Registration in India.

FAQs on Trust Registration.

To register a trust, you need to draft a trust deed outlining the trust’s objectives, details of trustees, beneficiaries, and rules. The deed must be signed by the settlor and trustees in the presence of witnesses. Once executed, it should be submitted for registration at the local Sub-Registrar’s office or the Charity Commissioner’s office, depending on the state laws and jurisdiction.

In a strict legal sense, a trust is not a separate legal entity like a company or organization. It is a legal arrangement where the settlor transfers property to the trustee, who holds and manages it for the benefit of the beneficiary. This relationship and its terms are formalized through a trust deed.

The cost of trust registration depends on factors like location, legal fees, and government charges. For accurate estimates, it’s best to consult legal professionals familiar with local regulations.

Registering a private trust involves drafting a trust deed that clearly states its objectives, details of the trustees and beneficiaries, and the rules for managing the trust. This deed must be signed by the settlor and trustees in the presence of witnesses. After execution, the trust deed is submitted for registration with the appropriate authority, as per the local laws and jurisdiction.

Section 12A of the Income Tax Act in India allows trusts and charitable institutions to register for tax exemption eligibility. Registration under this section is mandatory for availing benefits under Section 80G, which provides tax deductions to donors. Without 12A registration, a trust cannot claim exemption on its income or offer tax benefits to its contributors.