Partnership Firm Registration

Partnership Firm Registration.

Partnership firm registration is the legal process of formally establishing a business partnership between two or more individuals. While registration is not mandatory under the Indian Partnership Act, 1932, a registered firm enjoys several legal benefits, such as the ability to sue in court and enforce contractual rights.

To register a partnership firm, partners must draft a Partnership Deed outlining roles, profit-sharing, duties, and other key terms. The deed is submitted along with an application to the Registrar of Firms in the respective state. Required documents typically include PAN cards, ID/address proofs of partners, and proof of the firm’s address.

Registered firms have greater credibility and are better positioned for business growth, government tenders, and bank loans. Though optional, registration offers long-term advantages by protecting the rights and responsibilities of all partners involved.

Partnership Firm Registration With Onecall Tax Solution

Benefits of Partnership Firm Registration.

Legal Recognition and Protection

A registered partnership firm can sue or be sued in its own name, allowing legal enforcement of contractual rights and obligations among partners and with third parties.Access to Funding and Loans

Registered firms are more credible in the eyes of banks and financial institutions, making it easier to secure loans, open current accounts, and attract investors.Better Dispute Resolution

In case of conflicts between partners, registration ensures legal support for dispute resolution as only registered firms can enforce claims against partners or third parties in court.

Who can apply for Partnership Firm Registration.

Indian Citizens

Any Indian citizen who is competent to contract (as per the Indian Contract Act, 1872) can become a partner and apply for registration of a partnership firm.Minimum Two Partners

A minimum of two individuals is required to form a partnership firm. These partners can jointly apply for registration with the Registrar of Firms.Entities or Organizations

In certain cases, companies, LLPs, or other registered entities can also become partners in a partnership firm, subject to agreement and legal provisions.

Documents required for Partnership Firm Registration.

| Document | Details |

|---|---|

| Partnership Deed | A written agreement detailing the name, nature of business, partner details, profit-sharing ratio, and other terms of the partnership. |

| PAN Card of Partners | Mandatory identity proof for all partners; required for tax registration and other compliance. |

| Address Proof of Partners | Aadhaar Card, Voter ID, Passport, or Driving License showing the current residential address of each partner. |

| Identity Proof of Partners | Additional verification documents such as Passport, Voter ID, or Driving License. |

| Photographs of Partners | Recent passport-sized color photographs of all partners. |

| Proof of Firm’s Address | Utility bill (electricity/water/property tax), rent agreement (if rented), or ownership documents of the business premises. |

| No Objection Certificate (NOC) | Required from the property owner if the business operates from rented premises. |

| Application Form (Form 1) | Filled and signed application form submitted to the Registrar of Firms for registration. |

| Affidavit/Declaration | Statement confirming the intent to form a partnership and compliance with applicable laws, in the prescribed format. |

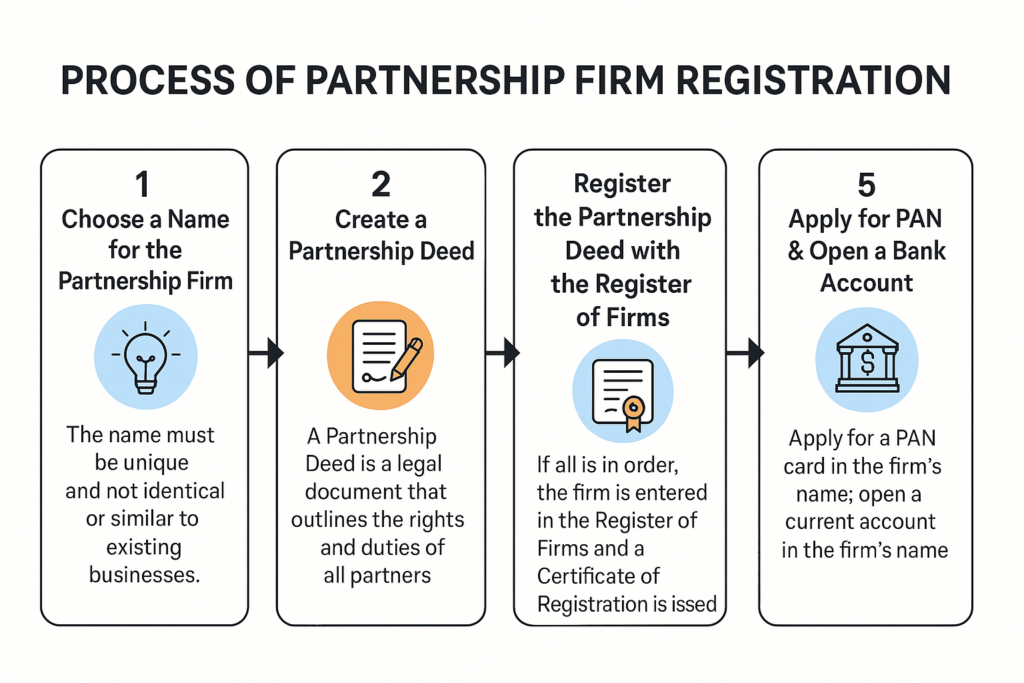

Process of Partnership Firm Registration.

FAQs on Partnership Firm Registration.

Registration of a partnership firm is not mandatory under Indian law. However, an unregistered firm faces certain legal limitations. Partners cannot sue each other or the firm in court to enforce their rights. Similarly, the firm cannot file a case against a third party for enforcement of contractual rights. These restrictions can hinder legal protection and dispute resolution, making registration advisable.

In India, any individual competent to contract can become a partner in a Partnership Firm. While minors cannot become full partners, they may be admitted to the benefits of partnership with the consent of all partners. Additionally, entities like companies and LLPs can also join as partners, provided it is allowed under the Partnership Deed and complies with the Indian Partnership Act, 1932.

There is no minimum capital requirement to start a Partnership Firm in India. Partners can contribute any agreed amount as capital, and it can be in any form—tangible (like cash or property) or intangible (like goodwill or intellectual property). The capital contribution can be made in equal or unequal ratios, as mutually decided and mentioned in the Partnership Deed.

Partners in a Partnership Firm must be major, meaning they should be at least 18 years old. They must also be of sound mind and not disqualified by any law from entering into a valid contract. These conditions ensure that all partners are legally capable of managing business responsibilities and obligations as per the Indian Contract Act, 1872.

Yes, a partner can transfer their interest in the partnership firm to an outsider; however, this can only be done with the consent of all other partners. Without unanimous approval, such a transfer is not valid. This restriction helps maintain trust and mutual understanding among partners, as partnerships are based on personal relationships and collective decision-making.