Nidhi Company Registration

Nidhi Company Registration.

A Nidhi Company is a type of non-banking financial company (NBFC) in India, formed under Section 406 of the Companies Act, 2013. It is established with the purpose of cultivating the habit of thrift and savings among its members. Nidhi companies operate by collecting deposits and lending them exclusively to their members. They are typically formed for mutual benefit and are restricted to the activities of borrowing and lending among members.

To register a Nidhi company in India, it must be incorporated as a public company with at least seven members and three directors. The company’s primary function is to accept deposits from its members and provide loans, usually at reasonable interest rates. The company must also maintain a minimum net owned funds (NOF) of Rs. 10 lakh and comply with the regulations set forth by the Ministry of Corporate Affairs (MCA).

Nidhi companies are governed by specific rules and regulations to ensure financial stability and the protection of its members. The company must adhere to the provisions related to its operations, such as the submission of regular financial reports, conducting annual audits, and ensuring that all transactions are conducted transparently. Registration of a Nidhi company provides members with a safe and organized platform for saving and borrowing within a community framework.

Nidhi Company Registration With Onecall Tax Solution

Benefits of Nidhi Company Registration.

Easy Access to Financial Services

Nidhi companies allow members to easily access financial services like deposits and loans at competitive interest rates. Since these services are provided within the company’s community, the processes are generally more flexible and convenient.Low Operational Costs

Nidhi companies typically have lower operational costs compared to traditional banks or financial institutions. This is because they focus only on their members and do not require large-scale infrastructure or extensive marketing.Member Security and Trust

Since Nidhi companies are governed by strict regulations, they offer a secure and trustworthy environment for members. The emphasis on transparency, annual audits, and financial reporting helps build confidence among members, ensuring that funds are handled responsibly.

Who can apply for Nidhi Company Registration.

Indian Citizens

Only Indian citizens are eligible to apply for Nidhi company registration. The promoters must be residents of India, as foreign nationals are not allowed to form a Nidhi company.Minimum Seven Members

To apply for Nidhi company registration, a minimum of seven members is required to form the company. These members can be individuals or other entities.Minimum Three Directors

A Nidhi company must have at least three directors. These directors should be individuals, and at least two of them must be residents of India. Additionally, the directors should be of sound financial standing and must meet the eligibility criteria set by the Ministry of Corporate Affairs (MCA).

Documents required for Nidhi Company Registration.

| Document | Details |

|---|---|

| PAN Card of Directors | Mandatory identity proof for all directors; essential for company incorporation and tax purposes. |

| Address Proof of Directors | Aadhaar Card, Voter ID, Passport, or Driving License showing the current residential address of each director. |

| Identity Proof of Directors | Additional verification documents such as Passport, Voter ID, or Driving License. |

| Photographs | Recent passport-sized color photographs of all directors and shareholders. |

| Digital Signature Certificate (DSC) | Required for all proposed directors to digitally sign incorporation documents filed with the MCA. |

| Director Identification Number (DIN) | Automatically allotted upon company registration or can be applied separately before incorporation. |

| Proof of Registered Office Address | Utility bill (electricity/water/property tax) not older than 2 months, rent agreement (if applicable), or ownership documents of the office space. |

| No Objection Certificate (NOC) | Required from the property owner if the registered office is located in rented premises. |

| Memorandum of Association (MOA) | Defines the company’s objectives and scope of operations. |

| Articles of Association (AOA) | Contains the rules and regulations for the internal management of the company. |

| Declaration by Subscribers & Directors (INC-9) | Self-declaration regarding non-conviction and compliance under the Companies Act. |

| Consent to Act as Director (DIR-2) | Written consent from each director to serve on the board of the company. |

| Affidavit by Subscribers/Directors | Declaration confirming legal compliance, provided in the prescribed format. |

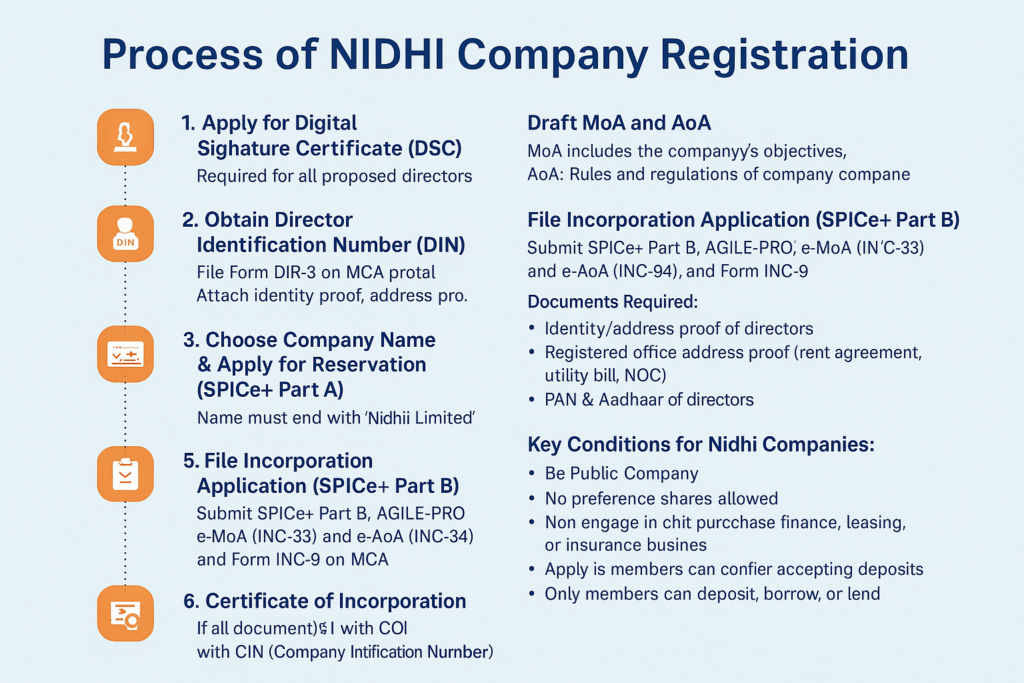

Process of Nidhi Company Registration.

FAQs on Nidhi Company Registration.

A Public Limited Company is ideal for large business operations, offering greater credibility and visibility. It allows easy access to loans, attracts investors, and builds trust with financial institutions, suppliers, and clients. With the ability to raise capital from the public, it supports expansion and enhances the company’s market image.

Nidhi Company registration typically takes 2–3 months, starting with obtaining a Digital Signature Certificate (DSC) and Director Identification Number (DIN). Delays may occur due to incomplete documents or issues at the Registrar of Companies (ROC) level.

Only individuals can become members of a Nidhi Company; bodies corporate or trusts are not eligible for membership under any circumstances.

A Nidhi Company incorporated under the Companies Act, 2013 is classified as a Public Limited Company. It must comply with all provisions applicable to public companies, even though it operates exclusively among its members for accepting deposits and lending.

In a Nidhi Company, a single member cannot hold more than ₹1 lakh in a savings account. Additionally, the interest rate offered on any deposits must not exceed 2% above the interest rate prescribed by nationalized banks for similar deposits. These limits ensure regulated financial practices and safeguard the interests of the members within the company.