ESI Registration

Employees State Insurance(ESI).

Employees’ State Insurance (ESI) registration is a mandatory scheme under the Employees’ State Insurance Act, 1948, designed to provide social security and health benefits to employees in India. It is managed by the Employees’ State Insurance Corporation (ESIC), an autonomous body under the Ministry of Labour and Employment.

All establishments employing 10 or more employees (in some states, 20) earning wages up to ₹21,000 per month must register for ESI. Employers contribute 3.25% and employees contribute 0.75% of the wages monthly.

The registration process is done online through the ESIC portal. Upon successful registration, a unique 17-digit ESI number is issued. This number allows employees and their dependents to access medical and other benefits like sickness, maternity, disability, and unemployment benefits.

Timely registration and compliance are essential to avoid penalties and ensure employee welfare.

ESI Registration With Onecall Tax Solution

Benefits of ESI Registration.

Medical Benefits – Comprehensive medical care for insured employees and their dependents, including hospitalization, outpatient care, and specialist consultations.

Sickness Benefits – Cash compensation at 70% of wages for up to 91 days during medical leave due to illness certified by an ESI doctor.

Maternity Benefits – Paid leave and medical care for insured women during pregnancy, confinement, miscarriage, or related complications.

Disability Benefits – Monthly payments in case of temporary or permanent disablement due to employment-related injury or disease.

Dependent Benefits – Financial support to dependents of a deceased employee who dies due to employment-related injury or illness.

Unemployment Allowance – Financial assistance for up to 24 months under the Rajiv Gandhi Shramik Kalyan Yojana in case of involuntary job loss.

Funeral Expenses – A lump-sum payment towards funeral costs of a deceased insured person.

Rehabilitation Services – Vocational rehabilitation and physical aid for insured persons suffering from physical disabilities due to employment injury.

Who can apply for ESI Registration.

Private Sector Employers – Employers in private establishments, factories, or companies with 10 or more employees (20 in some states) earning wages up to ₹21,000 per month are required to apply for ESI registration.

Shops and Establishments – Businesses, including shops, restaurants, and hotels, employing the required number of employees (10 or 20, depending on the state) must also register for ESI coverage.

Government Contractors and Sub-contractors – Employers in government or private contractors hiring employees in any industry or establishment where ESI provisions are applicable must obtain ESI registration.

Documents required for ESI Registration.

| Document | Details |

|---|---|

| Proof of Business Address | Utility bill (electricity/water), rent agreement, or property ownership documents for business premises. |

| Certificate of Incorporation | For companies — Certificate of Incorporation or Registration Certificate for LLPs or Partnership Deed for partnership firms. |

| PAN Card | PAN card of the business entity (for companies, LLPs, partnerships) or of the proprietor (for proprietorships). |

| Aadhaar Card | Aadhaar of the business owner, managing partner, or authorized signatory (for companies/partnerships). |

| Bank Account Details | Bank account number, IFSC code, and branch details for business transactions. |

| Employee Details | List of employees (with their details such as salary, designation, and address) covered under ESI. |

| Employee’s Salary Details | Salary slip or wage register for employees to verify the contribution details. |

| ESI Code of Previous Establishment (if applicable) | If the business was previously registered under ESI, the previous establishment’s ESI Code. |

| GST Registration (if applicable) | For businesses registered under GST, a copy of the GST registration certificate. |

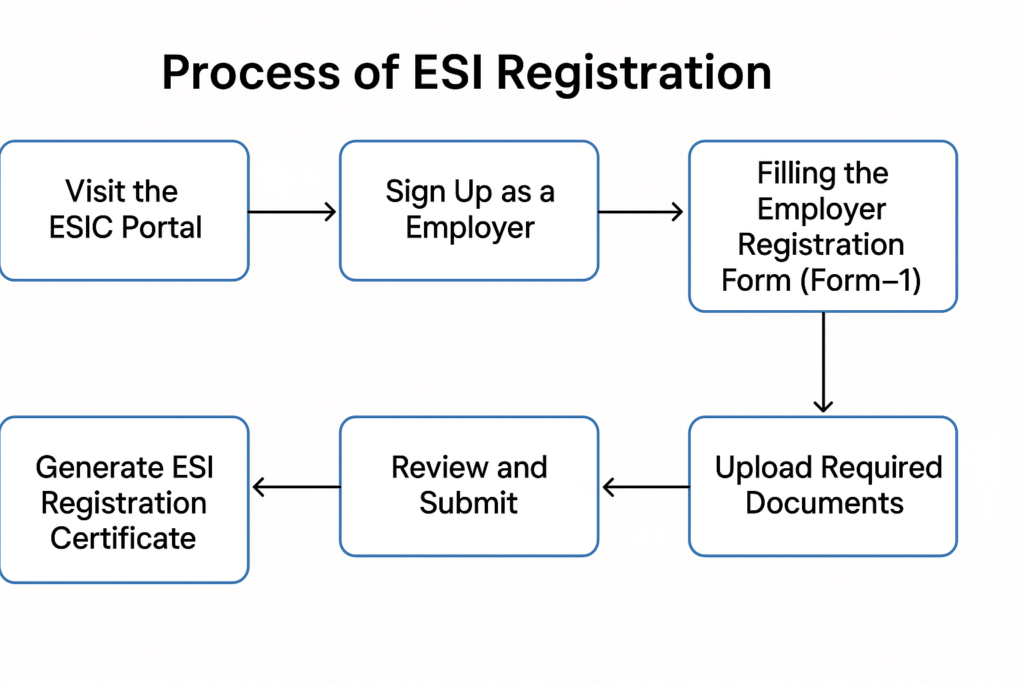

Process of ESI Registration.

FAQs on ESI Registration.

ESI registration is the process of registering a business entity under the Employees' State Insurance (ESI) Act, 1948, to provide medical and social security benefits to employees. It is mandatory for establishments with 10 or more employees (20 in some states) earning wages up to ₹21,000 per month. The registration process is done online through the ESIC portal, where a unique 17-digit ESI number is issued. Employers contribute 3.25% and employees contribute 0.75% of their wages to the scheme, ensuring employees receive healthcare, sickness benefits, maternity leave, and other social security benefits.

Any establishment or business entity with 10 or more employees (20 or more in certain states) earning wages up to ₹21,000 per month must register for Employees' State Insurance (ESI). This registration ensures employees receive medical care, sickness benefits, maternity benefits, and other social security services as mandated by the ESI Act, 1948.

Employees covered under ESI are entitled to various benefits, including medical care, sickness benefits (70% of wages during illness), maternity benefits, disablement benefits (temporary or permanent), dependent benefits in case of death due to work-related incidents, and funeral expenses. These benefits aim to provide comprehensive social security and welfare to employees and their families.

Yes, both the employer and employee contribute to ESI. The employer contributes 3.25% of the employee's wages, while the employee contributes 0.75%. These contributions are mandatory and ensure that employees receive medical, social security, and other welfare benefits under the Employees' State Insurance Act.

Yes, if an establishment ceases operations or no longer meets the criteria for ESI coverage, its registration can be canceled. The employer must notify the Employees' State Insurance Corporation (ESIC) for the cancellation process.